ETF Innovation

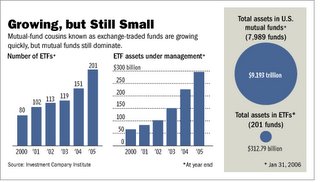

Lately innovation has been associated with technology, especially the web2.0 phenomenon. However innovation can be found in the most staid and unlikely places take Exchange Traded Funds (ETF's) for example. ETF's are an asset class I have often blogged about, are essentially index funds that trade like shares. They are a great way to play sector bets and I have been especially impressed by the country and geography ETF's as a way of international diversification. They are liquid and have low fees. Although ETF's have assets of $313 Billion, this number still dwarfs the $9.2 trillion of assets in mutual funds. (

source : WSJ)

source : WSJ)The ETF business is booming though, there are a handful of players

- Barclays lead the pack with its myriad of ishares

- State Street Global identified by its popular Spider (NYSE : SPY) ($128) and other ETF's.

- Vanguard joined the party with its Vipers

- Rydex is most well know for its equal weighted S&P 500 ETF (NYSE : RSP) ($174) is launching six new ETF's this week.

PowerShares burst on the ETF stage in late 2004 . They currently offer more than 35 ETF with $3.5 B under assets, some of the most esoteric and exotic ETF's are.

PowerShares Nanotechnology portfolio

PowerShares Water Resources portfolio

PowerShares Clean Energy portfolio

PowerShares Valueline timeliness portfolio

PowerShares MicroCap portfolio portfolio

Each of these offer never before available options to investors, this was true innovation and is bound to do well for its new owners. Amvescap looks richly valued at a P/S of 2.58, On a discounted free cash flow to equity basis, using growth rates seen in the industry the share price should be approximately $14, currently trades at $18.42

However the ETF industry looks to be growing especially with the industry now having approached the SEC for launching actively managed ETF's. I believe that PowerShares will continue its innovation and be a tremendous growth engine for Amvescap (NYSE : AVZ) ($18.42) (justifying a higher growth rate).

Amvescap will bring rich rewards to its investors, I believe in a few years Amvescap will itself be acquired most likely suitor the Boston giant Fidelity, who has been AWOL from this scene.

So the best way to play the ETF game buy the most innovative company in the business!!

1 Comments:

Interesting thoughts Ashish. In spite of being a strong proponent of investing in individual stocks, PowerShares Valueline timeliness portfolio was the first ETF I ever invested in. Valueline has an excellent track record amongst investment newsletters and this ETF is not completely passive as it picks 50 out of the 100 hundred stocks that Valueline features.

I looked up Amvescap as well after it bought PowerShares and came away with the same feeling as you that Amvescap currently looks overvalued.

Post a Comment

<< Home