Wall Street hates the Dow - Dow Chemical Company

Here is a company that had record revenues and earnings in 2005, is expected to do the same in 2006, is a Fortune 50 company, has great

brands and is a well known innovator.

brands and is a well known innovator.Trades at an incredibly low P/E of 8.5, P/S of 0.8 pays a rich dividend of 3.5%. So why is Dow Chemical (NYSE:DOW) ($39.8), the largest chemicals/plastics company being ignored by wall street, because of a few reasons:

-high costs of natural gas and oil increase the costs of production

-perceived as commodity, boring businesses no sex appeal at all

Our retorts to the above:

-Dow is in a boring business, we actually like boring.

-Not all of it is commodity businesses, they have specialty agriculture, automotive and coatings also the company is investing in performance businesses to avoid the cyclical gyrations of the bulk chemicals business.

-Dow Chemical has been one of the engines of innovation in the specialty materials sector.

-The cost of oil and gas is a concern; here are two recent articles both could be construed as positives for DOW.

According to the Barron's article "Natural Gas: Lower Still" dated April 15th by Spencer Jakab (subscription required) -"Despite falling nearly 60% from their December peak to a recent $7.135 per million BTU's, gas futures may need to go below $5.50 to soak up a surplus unlike any ever seen by the industry. Total gas in underground storage at end of March, the official end of the heating season, was 1.695 trillion cubic feet, a whopping 63% above the average for the past five years and 13% more than the previous record high."

And then today's New York Times article "Chemical Companies Look to Coal as an Oil Substitute" by Claudia Deutsch has a quote from Dow's CEO Andrew N. Liveris "We want to be economically feasible in the United States, and coal enables us to do that," The article further goes on to say Dow Chemical, has tripled its research into coal-based ingredients. I will grant that this is perhaps a pipe dream or a long term soultion. Also I do not expect oil prices to fall but then chemicals and speciality derivatives are a part and parcel of our lives and eventually DOW will be able to pass the costs down to the consumer.

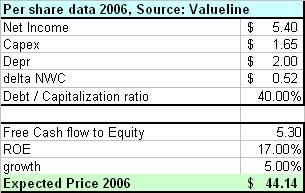

So we took a detailed look using Valueline data at DOW Chemicals

As seen on the left Free cash flow to Equity DCF value stands at $44, The stock trades at $39.8 close to its 52 week low and a 10% discount to the DCF value of $44. This is a classic Buffet/Graham situation where a gem is out of favor with the street, on basis of exagerated pessimism regarding high oil and gas prices. This company will deliver rich gains to investors in the next 5 years, and while you wait for it a 3.5% dividend is icing on the cake. (Disclaimer : I will take a position in DOW soon)