Brown v. Board of Fedex

The two companies that are and will ride the wave of globalization and e-commerce (thanks to Web2.0 this is no longer a taboo word) are Atlanta based United Parcel Service (NYSE : UPS) and Memphis based FedEx (NYSE : FDX). Fierce competitors these two firms have epitomized efficiency. We have talked about capitalizing on this trend a while ago. But given a choice between the two who wins? H

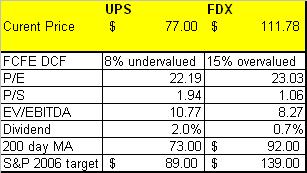

ere is the result of both fundamental and relative analysis

ere is the result of both fundamental and relative analysisOn a strict fundamental valuation basis (using ValueLine and S&P reports), FDX looks rich about 15%, however I am inclined to believe that the growth rates these two esteemed publications have put out are low, anybody who has used the

Po=FCFE/(r-g) model or its variants

knows a small tweaking of the growth rate can do wonders to your results!!!

Based on a 13% growth rate the valuation comes out to $133 for FDX, It is also looks undervalued on a P/S and EV/EBITDA basis. Having said that FDX has had a remarkable run in the few months (look at the 200 day moving average) and UPS is still a great company, especially with that 2% dividend. It's just that I think Fedex has more juice in it.

- FDX has a small edge on UPS in China (2 extra routes)

- FDX is recognized as a premium brand, may give it more pricing power

- FDX is a smaller company ($32B) versus UPS' $84B - more nimble and a faster growth story

0 Comments:

Post a Comment

<< Home